How to Take Advantage of New Federal Heat Pump Rebates

Great news for those looking to upgrade to a more energy-efficient heating and cooling system. Starting from January 2023, two new federal tax credits and rebate savings incentives make switching to a greener heat pump system easier and cheaper than ever before.

The Energy Efficient Home Improvement Credit and the High Efficiency-Electric Home Rebate Program, introduced as part of the Inflation Reduction Act in August 2022, offer significant cost savings for those looking to install a heat pump system. What’s more, depending on your circumstances, you could even be eligible for the full rebate.

Moreover, with the potential to save up to $8,000, we feel this is an opportunity not to be missed. So we’ve put together everything you need to know about the benefits of heat pumps and which systems qualify for the tax credit or rebates savings available.

The Inflation Reduction Act

You don’t need to know every tiny detail of the Inflation Reduction Act. However, here’s a quick summary to help you understand the main ins and outs.

The Background

After over a year of planning and negotiations, the Federal Government passed the Inflation Reduction Act (IRA) in August 2022. The main impetus for this Act is to help halt climate change. The Earth is struggling, and our kids and grandkids face more natural disasters if we don’t act soon to stop global warming.

By offering cash incentives to homeowners willing to swap to greener energy sources, it’s hoped that the US can reduce its carbon emissions by 40% by 2030 – no small feat! The Act also pledges over $350 billion in climate action, clean energy jobs, and environmental justice, more than any US Government has committed to before.

What the Act Means for You

Let’s dig deeper into the details. You’re in luck if you’re a homeowner excited about embracing environmentally friendly energy solutions such as electric vehicles and heat pumps.

And that’s not all. For those struggling with higher costs of living and lower incomes, you might qualify for the IRA’s heat pump rebate program. The rebate aims to make greener energy options available to all by covering anywhere from 50% to the entire cost of installing your heat pump.

In short, the Act is a fantastic opportunity for everyone to take responsibility for their carbon footprint and start the move towards more sustainable energy sources.

What is a Heat Pump?

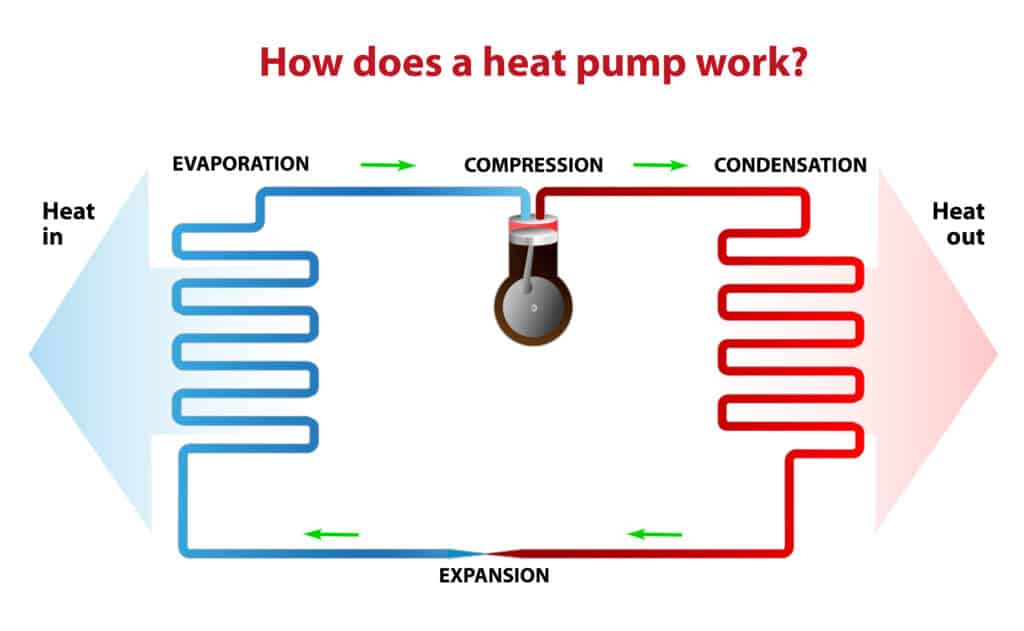

A heat pump is a device that transfers heat from one place to another. Using a compressor, a heat pump works by moving refrigerant around the system between the hot side (the evaporator) and the cold side (the condenser).

Benefits of an Energy-Efficient Heat Pump

There are several benefits to having a heat pump installed, including:

Lower Utility Bills

Heat pumps are a more energy-efficient way of heating than some other systems, which reduces your energy bills. These systems are designed to use only what they need, reducing excess energy usage and causing less stress on your system.

State Requirements

Eco-Friendly

Heat pumps are more efficient, using only enough resources to heat your home to the optimal level. As a result, energy and natural resources are conserved, leading to a lower impact on the environment.

Which Systems Qualify?

Before you dash out to buy a new heat pump, there are a few other issues to consider. For example, not every heat pump is eligible for tax credit or rebates savings. Here’s a quick overview, but checking with your local HVAC professional is always advisable.

Energy Star Systems

Obtaining an Energy Star Certification ensures that you’re buying a heat pump that has been meticulously inspected and certified. A product must undergo a series of professional tests conducted by laboratories supervised by the EPA before receiving this certification. So you can be sure you’re getting a top product that fits the Federal Government IRA criteria.

Different Systems Covered

If you need more time before transitioning to a heat pump, or if a heat pump is incompatible with your home, alternative options can still make you eligible for savings. For example, provided they meet the energy-efficient criteria, you could install a new furnace, HVAC system, or boiler. So don’t despair if a heat pump isn’t the right option for you.

CEE Tier 1 & 2 Requirements

Not every heat pump is produced to the same standard. To qualify for Federal Government savings, you must ensure the pump you purchase sits within the Consortium of Energy Efficiency (CEE) Tiers 1 or 2.

What Federal Tax Credits Are Available?

Tax 25C

This tax credit is a nonbusiness property energy credit. It allows you to claim up to 30% capped tax credit for installing energy-efficient products like heat pumps, water heaters, and electric panels or for carrying out energy audits.

The excellent news about this credit is that it’s not a lifetime credit. It renews yearly. Anyone with adequate tax liability to offset can qualify for Tax 25C.

Tax Credit Amounts

There are various amounts allocated to different products and appliances. The principal amounts are as follows:

- Heat Pumps – up to $2,000

- Air Conditioners – up to $600

- Furnaces – up to $600

HEEHRA Act Energy Efficiency Rebates

If you’re worried about the cost of purchasing a new heat pump, promising news is on the horizon. Lower-income households that earn 80% less than the average income in their area are eligible for a rebate covering the total cost of a new heat pump – a rebate worth up to $8000!

You can also get rebates for other energy-saving products:

- Electric stove/cooker top $640

- Electric wiring $2,500

- Weatherization $1,600

- Heat Pump Water Heater $1,700

Needless to say, this program makes it easier for homeowners to switch to an energy-efficient heating system without breaking the bank.

Save More with Local Energy Rebates

The rebate system doesn’t stop with Federal rebates. In addition, you could be entitled to even more money back through individual State energy office incentives. These local financial payments differ depending on where you live. So it’s worth checking out your local energy council to see if you qualify for any additional money back.

Also, check with your local utility company to see if they offer savings on your energy bills.

Combining State and Federal Rebates

Thinking of combining both Federal and State rebates. It’s not impossible, but the regulations are still a little unclear. It depends on the State’s interpretation of the rules. However, as Federal money isn’t funding the State rebates, you should still be eligible for both.

How to Apply for Tax Credits and Rebates

Want to know the difference between a tax credit and a rebate and which one you should apply for? We’ve got covered.

A rebate is a discount given at the time of purchase. For example, you find a registered contractor to fit your heat pump, they complete all the admin, and you get money off the final purchase price. However, as mentioned earlier, these rebates are only available to low or moderate income households.

If you don’t qualify for a rebate, you can still save money by applying for a tax credit. The difference is you pay the full price of the replacement installation at the time of purchase and claim back up to 30% via your tax return.

Puzzled over how to apply for the tax credit? The best advice is to seek expert help from your tax advisor. They’ll ensure you fill your form in correctly to receive the total amount you’re eligible for in credits.

Ready to make the most of these savings? Contact the HVAC experts at Bell Bros today to find out more about Federal Energy Efficient heat pumps.